18+ Recasting mortgage

Mortgage Recasting is sometimes an option when borrowers want a lower payment yet theyre satisfied with their original term and rate. When you purchase a home your lender calculates your mortgage paymentsbased on the principal balance and the loan term.

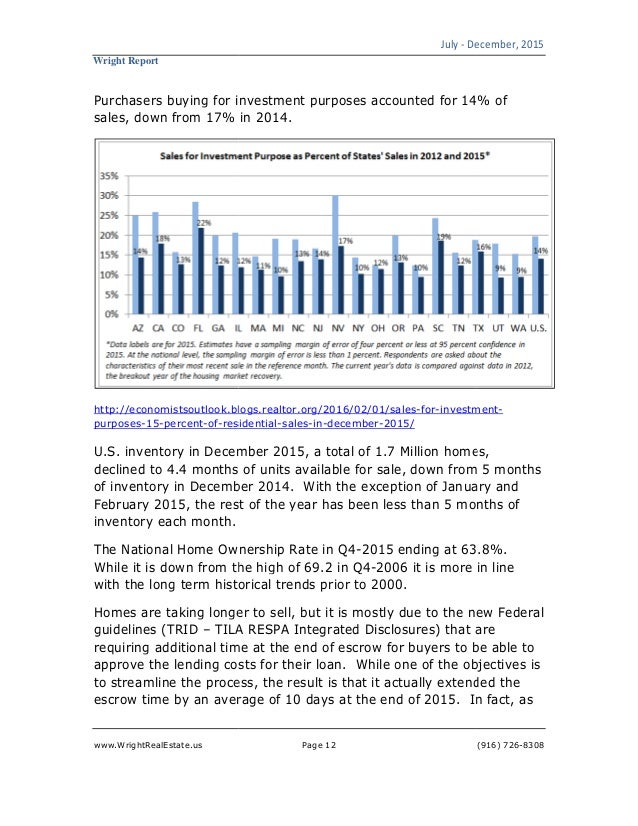

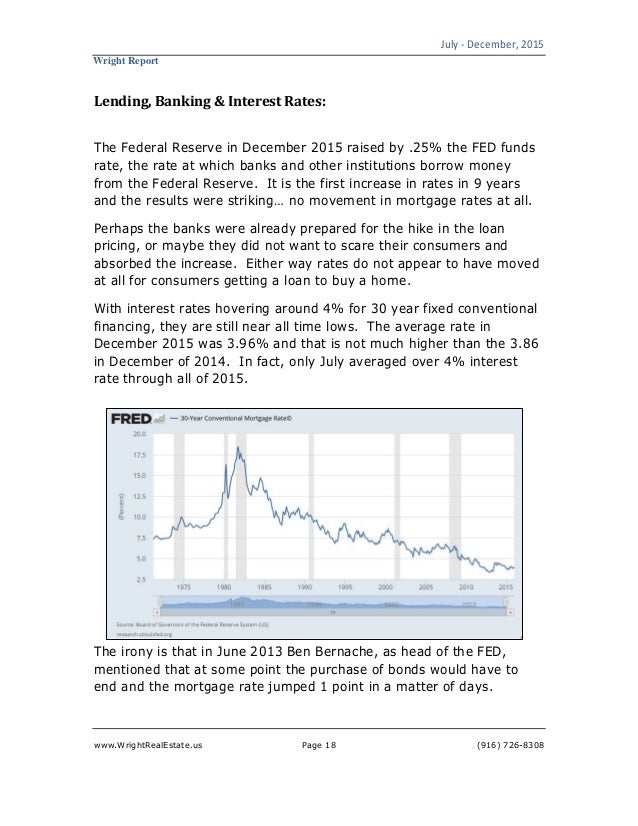

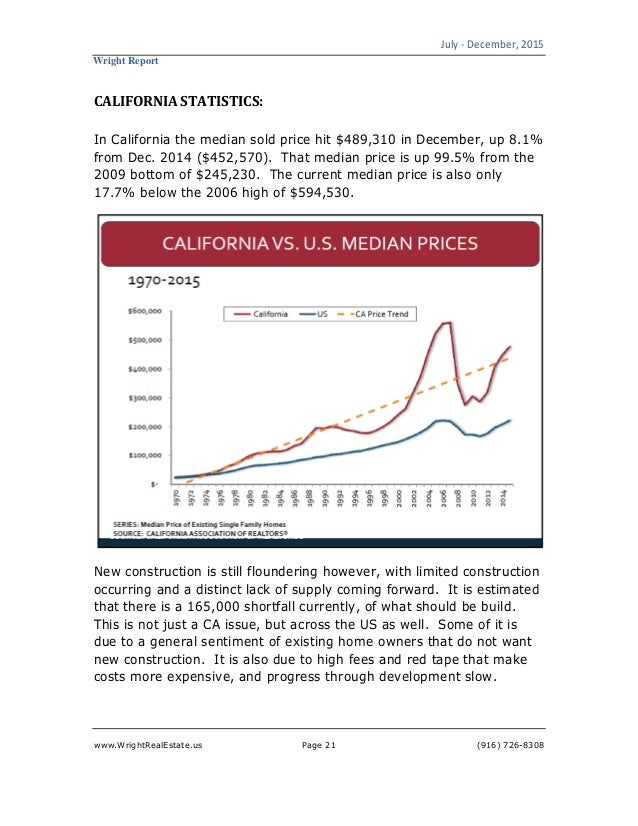

Wright Report Q3 4 2015

Mortgage recasting is a way to reduce the interest expenses without shortening the loan term where remaining payments are calculated based on a new amortization schedule and is ideal for people who recently received a large sum of money and want to reduce their mortgage expenses.

. A mortgage recast is when a lender recalculates the monthly payments on your current loan based on the outstanding balance and remaining term. Some mortgages may allow. Contact your lender or loan servicer.

Recasting calculator is useful for homeowners who wants to pay a lump sum toward their. This would purely be to put into. A mortgage recast is when your lender recalculates your remaining monthly payments based on the outstanding balance and remaining term.

During a mortgage recasting an individual pays an additional lump sum toward their principal and their mortgage is then recalculated based on the new balance. Make sure recasting is available from your lender or loan servicer and for your loan type. Apply Easily Get Pre Approved In 24hrs.

A recast mortgage is a process of reevaluating monthly mortgage payments by taking the loans balance and dividing it by the remaining months left on the mortgage term. Recasting your mortgage means youll contribute a significant amount of cash upfront to pay off part of your debt and spread out the new lower loan amount over the. Recasting the loan would involve amortizing the remaining 250000 balance over the remaining 25-year term.

You need to decrease your payment to cash flow a rental - If you have a rental property with a mortgage that doesnt currently cash flow positive recasting a mortgage can. Every time you make a payment your balance goes down. This is also called a re-amortization of your loan Your lender restructures your monthly payment schedule for the remainder of your loan term to account for the lump-sum payment.

Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Assuming its an involuntary one performed by your lender. But you can only recast a mortgage after you make a one.

The basic steps of mortgage recasting are. A mortgage recast restructures your loan so that the remaining balance is spread out over the rest of the loan term. What Is a Mortgage Recast.

One of the advantages of recasting. Under these circumstances the monthly paymentassuming a. Fast Approval Low APR Rates No Hidden Fees Reliable Reviews Online Comparison.

Gross rental income would be 316k net annual income after all expenses personal and rental related and taxes would be 62111 or 5176month. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. When a Recast Increases Your Mortgage Payment.

A feature in some types of mortgages where the remaining scheduled principal and interest payments are recalculated based on a new amortization schedule. Thus if a persons main objective is to reduce monthly payments rather than paying. Now the loan balance is approximately.

Compare offers from our partners side by side and find the perfect lender for you. If you decide to do a mortgage recast you can put that 30000 toward a one-time principal payment to reduce your loan balance. Ad Best Home Mortgages Compared Reviewed.

A loan recast can actually increase your monthly payment. Perhaps their existing interest rate is considerably lower than current market rates. Thus when you recast your loan you make a large.

Recasting your mortgage involves making a lump-sum payment that reduces your mortgage balance and leads to a lower monthly payment. A mortgage recasting or loan recast is when a borrower makes a large lump-sum payment toward the principal balance of their mortgage and the lender in turn reamortizes the. A borrower might also consider Mortgage Recasting after receiving a windfall like an inheritance bonus or insurance payout.

A principal payment or large lump sum payment on your mortgage is known as mortgage recasting or re-amortizing. Mortgage Recast Calculator to calculate how much you can save by recasting your mortgage. A mortgage recast is when you make a large one-time payment to reduce your mortgage balance and your lender recalculates your monthly payment as a result.

Consumer Decision Journey Premium Luxury Auto Global Consumer Insights Pdf Free Download

Banks Technology

2

Banks Technology

Willamette Week April 13 2022 Volume 48 Issue 23 You Can T Afford This By Willamette Week Newspaper Issuu

Wright Report Q3 4 2015

Pin On Being That Girl

Seven Days April 27 2022 By Seven Days Issuu

Wright Report Q3 4 2015

Economy Of The United States Wikiwand

2

Wright Report Q3 4 2015

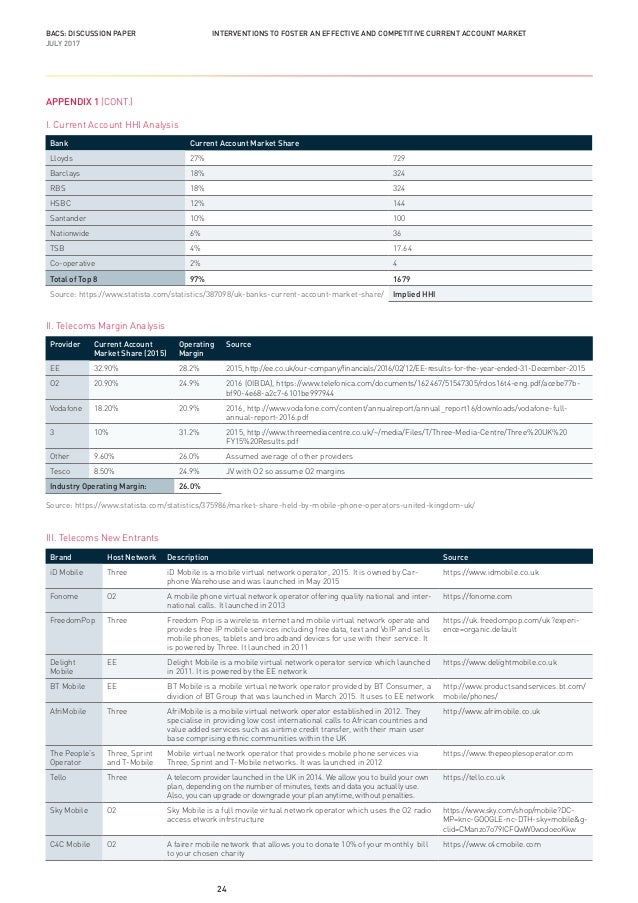

Current Account Switch Service Interventions To Foster An Effective

Davey Pepsigraps Twitter

Seven Days February 26 2014 By Seven Days Issuu

Consumer Decision Journey Premium Luxury Auto Global Consumer Insights Pdf Free Download

Economy Of The United States Wikiwand